Mileage Template Google Sheets

Mileage template google sheets - Then, you can choose to deduct based on the standard mileage rate or the. The total miles traveled especially in a given period of time. Each business mile over 10,000 in the tax year. An allowance for traveling expenses at a certain rate per mile. Web the standard mileage rate is a simple way to deduct miles. Aggregate length or distance in miles: This is called an ‘approved amount’. It is also important that when you do mileage for your employer, that mileage must be connected to the business in some way. You can also use this tool to calculate the number of frequent flyer miles you will earn for an upcoming flight, or check the distance from where you are now to any city in the. Enter your route details and price per mile, and total up your distance and expenses.

Web the mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest irs standard mileage rate of 58.5¢ as of january 1, 2022. First 10,000 business miles in the tax year. To use the standard mileage rate for a vehicle, you have to choose this method in the first year of using your car in your business. Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united states, disregarding traffic conditions. Web from tax year 2011 to 2012 onwards.

Mileage Spreadsheet Uk Google Spreadshee mileage log spreadsheet uk

Web mileage noun [u] (money for travel) (also mileage allowance) the amount of money that you are paid or that you must pay for each mile you travel: It is also important that when you do mileage for your employer, that mileage must be connected to the business in some way. To use the standard mileage rate for a vehicle, you have to choose this method in the first year of using your car in your business.

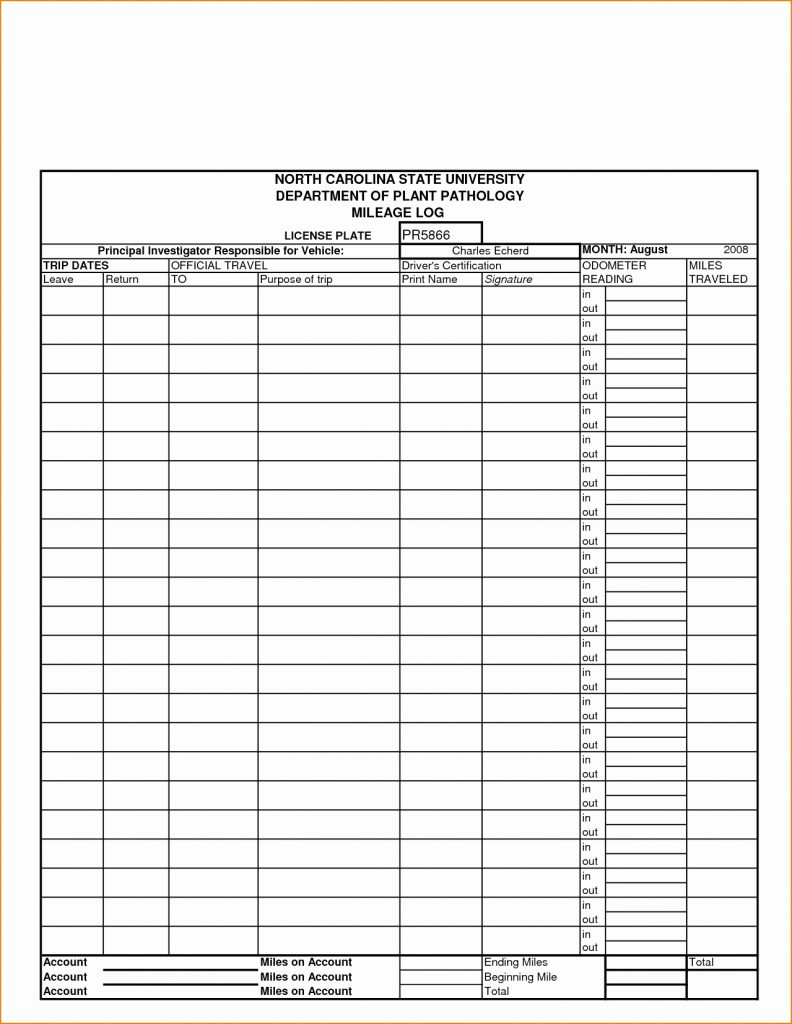

24+ Mileage Log Examples in Numbers Excel MS Word Pages PDF

Web the standard mileage rate is a simple way to deduct miles. The car costs £70 a day. Web the mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest irs standard mileage rate of 58.5¢ as of january 1, 2022.

The Balance Car Maintenance Log Template Google Sheets

Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united states, disregarding traffic conditions. Aggregate length or distance in miles: Web mileage allowance payments you’re allowed to pay your employee a certain amount of maps each year without having to report them to hmrc.

Autoblog de h3b.us

Web the standard mileage rate is a simple way to deduct miles. First 10,000 business miles in the tax year. Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united states, disregarding traffic conditions.

Mileage Spreadsheet For Irs Printable Spreadshee mileage spreadsheet

It is based on the miles traveled, not the actual cost of maintaining your car. It is also important that when you do mileage for your employer, that mileage must be connected to the business in some way. Then, you can choose to deduct based on the standard mileage rate or the.

Free Mileage Log Template Excel, Word Download Here

As an employee, you need to have incurred and. Web mileage allowance payments you’re allowed to pay your employee a certain amount of maps each year without having to report them to hmrc. Each business mile over 10,000 in the tax year.

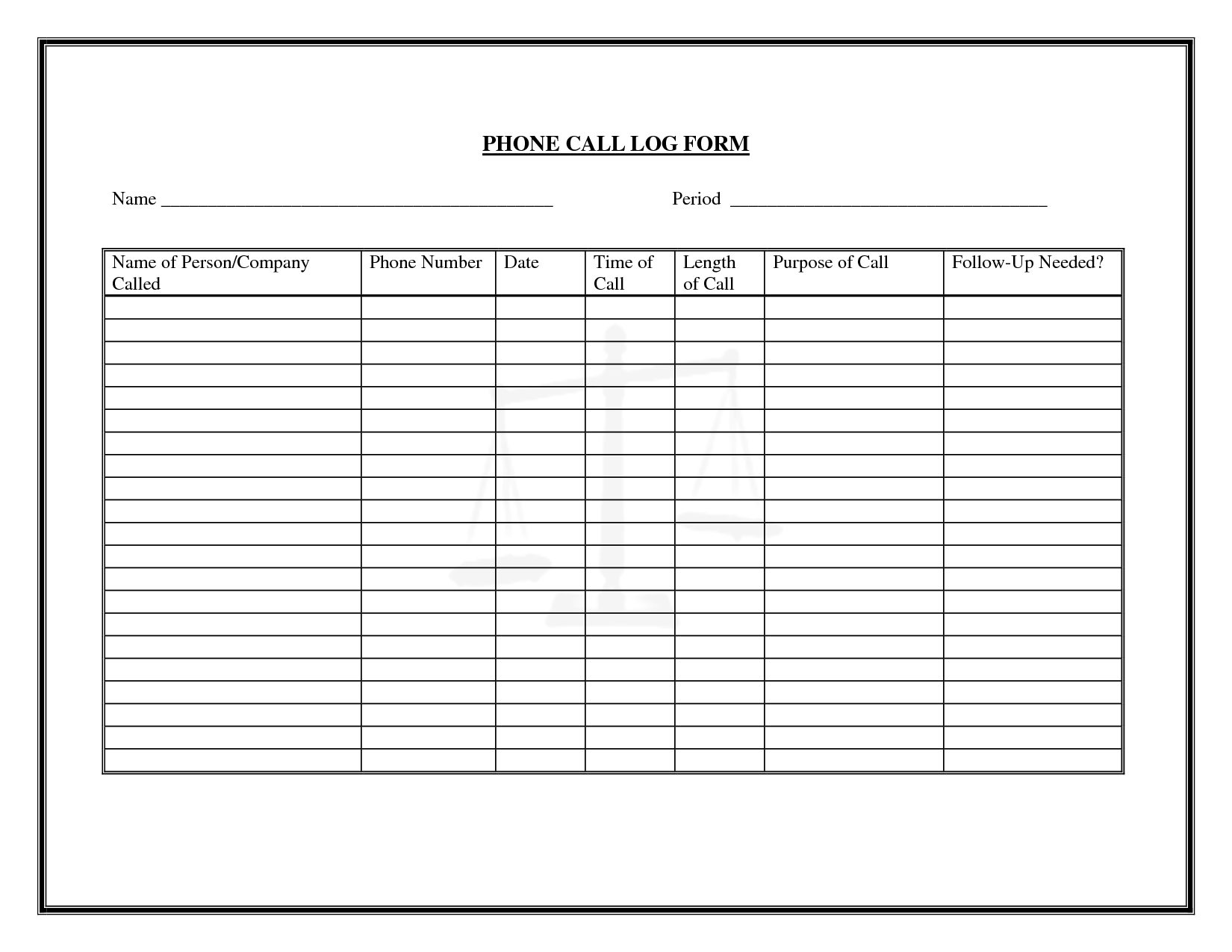

Log Sheet Template Free PDF Template

An allowance for traveling expenses at a certain rate per mile. Aggregate length or distance in miles: Each business mile over 10,000 in the tax year.

First 10,000 business miles in the tax year. Web mileage noun [u] (money for travel) (also mileage allowance) the amount of money that you are paid or that you must pay for each mile you travel: You can also use this tool to calculate the number of frequent flyer miles you will earn for an upcoming flight, or check the distance from where you are now to any city in the. Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united states, disregarding traffic conditions. Web from tax year 2011 to 2012 onwards. The total miles traveled especially in a given period of time. As an employee, you need to have incurred and. Web the mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest irs standard mileage rate of 58.5¢ as of january 1, 2022. Enter your route details and price per mile, and total up your distance and expenses. The car costs £70 a day.

Web mileage allowance payments you’re allowed to pay your employee a certain amount of maps each year without having to report them to hmrc. To use the standard mileage rate for a vehicle, you have to choose this method in the first year of using your car in your business. It is also important that when you do mileage for your employer, that mileage must be connected to the business in some way. This is called an ‘approved amount’. An allowance for traveling expenses at a certain rate per mile. Web the standard mileage rate is a simple way to deduct miles. It is based on the miles traveled, not the actual cost of maintaining your car. Each business mile over 10,000 in the tax year. Then, you can choose to deduct based on the standard mileage rate or the. Aggregate length or distance in miles:

Like This

Art Placard Template

Astrodesigns Com Free Templates