Annuity Calculator Excel Template

Annuity calculator excel template - Partial withdrawals may reduce benefits available under the contract as well as the amount available upon a full surrender. You buy an annuity by making either a single payment or a series of payments. Web an annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract, regardless of market conditions. Compare the latest annuity rates and find out how they're calculated in this guide. Web an annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future, such as after retirement. Web an annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. Web an annuity is a financial product that provides certain cash flows at equal time intervals. You can customize an annuity based on a variety of options, including how long you think you’ll live, when you want your payments to start and whether. Web an annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Annuities are created by financial institutions , primarily life insurance companies, to provide regular income to a client.

Web a number of factors can affect how much annuity income you'll receive, such as life expectancy and interest rates. Deposits in savings, rent or lease payments, and insurance premiums are examples of annuities due. Web annuity management führt nachhaltig zu mehrgeschäft und erhöht dauerhaft den customer lifetime value ihrer bestandskunden. Earnings are taxed as income upon withdrawal. Darüber hinaus erfahren sie mehr über ihre kunden, erkennen frühzeitig trends und möglichkeiten für die gewinnung von zusatzgeschäften und profitieren von wertvollem kundenfeedback sowie sales insights.

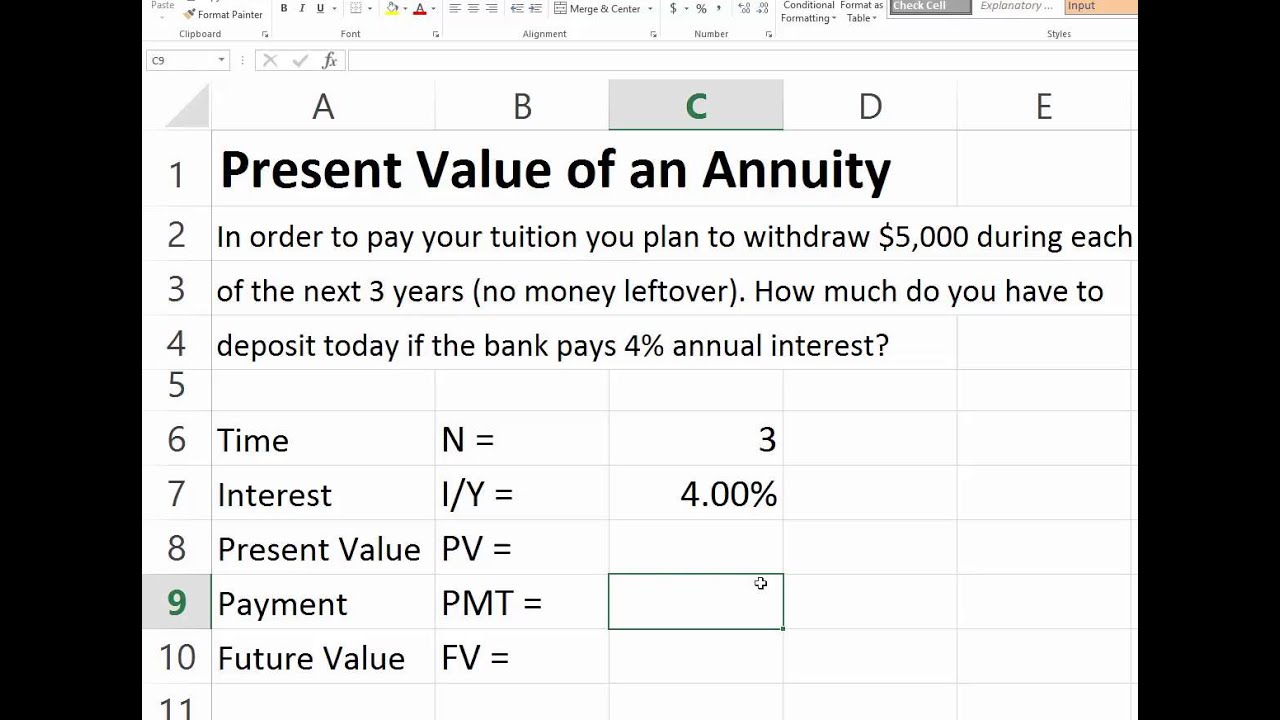

Present Value of Ordinary Annuity in Excel YouTube

Early withdrawals may be subject to withdrawal charges. You can customize an annuity based on a variety of options, including how long you think you’ll live, when you want your payments to start and whether. Web an annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future.

Future Value Of Ordinary Annuity Due Table Photos Table and Pillow

Web an annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract, regardless of market conditions. Web an annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Darüber hinaus erfahren sie mehr über ihre kunden, erkennen frühzeitig trends und möglichkeiten für die gewinnung von zusatzgeschäften und profitieren von wertvollem kundenfeedback sowie sales insights.

Mileage Log Excel Templates

Web an annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Web an annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future, such as after retirement. Deposits in savings, rent or lease payments, and insurance premiums are examples of annuities due.

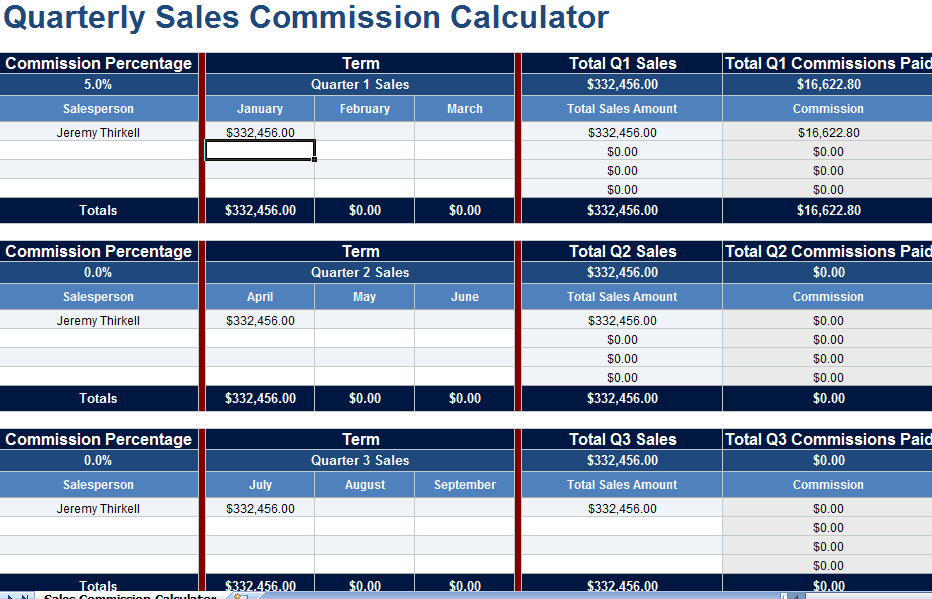

Quarterly Sales Commission Calculator Spreadsheet

Earnings are taxed as income upon withdrawal. You buy an annuity by making either a single payment or a series of payments. You can customize an annuity based on a variety of options, including how long you think you’ll live, when you want your payments to start and whether.

Recurring Payment Excel Spreadsheet Sample Excel Templates

Annuities are created by financial institutions , primarily life insurance companies, to provide regular income to a client. Partial withdrawals may reduce benefits available under the contract as well as the amount available upon a full surrender. Web an annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future.

Present Value Interest Factor Annuity Table Pdf

You buy an annuity by making either a single payment or a series of payments. Web a number of factors can affect how much annuity income you'll receive, such as life expectancy and interest rates. Compare the latest annuity rates and find out how they're calculated in this guide.

How To Calculate Discounted Payback Period In Excel

Web a number of factors can affect how much annuity income you'll receive, such as life expectancy and interest rates. Web an annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future, such as after retirement. Darüber hinaus erfahren sie mehr über ihre kunden, erkennen frühzeitig trends und möglichkeiten für die gewinnung von zusatzgeschäften und profitieren von wertvollem kundenfeedback sowie sales insights.

Web a number of factors can affect how much annuity income you'll receive, such as life expectancy and interest rates. Web an annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future, such as after retirement. Darüber hinaus erfahren sie mehr über ihre kunden, erkennen frühzeitig trends und möglichkeiten für die gewinnung von zusatzgeschäften und profitieren von wertvollem kundenfeedback sowie sales insights. Compare the latest annuity rates and find out how they're calculated in this guide. Web annuity management führt nachhaltig zu mehrgeschäft und erhöht dauerhaft den customer lifetime value ihrer bestandskunden. Annuities are created by financial institutions , primarily life insurance companies, to provide regular income to a client. Deposits in savings, rent or lease payments, and insurance premiums are examples of annuities due. Web an annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract, regardless of market conditions. Partial withdrawals may reduce benefits available under the contract as well as the amount available upon a full surrender. Web an annuity is a financial product that provides certain cash flows at equal time intervals.

Web an annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. Web an annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. You can customize an annuity based on a variety of options, including how long you think you’ll live, when you want your payments to start and whether. You buy an annuity by making either a single payment or a series of payments. Early withdrawals may be subject to withdrawal charges. Earnings are taxed as income upon withdrawal.

Like This

Patriotic Invitation Template

Pokemon Card Blank Template